BC debt grows, Province lacks clear plan to address it

(Image courtesy of CBC)

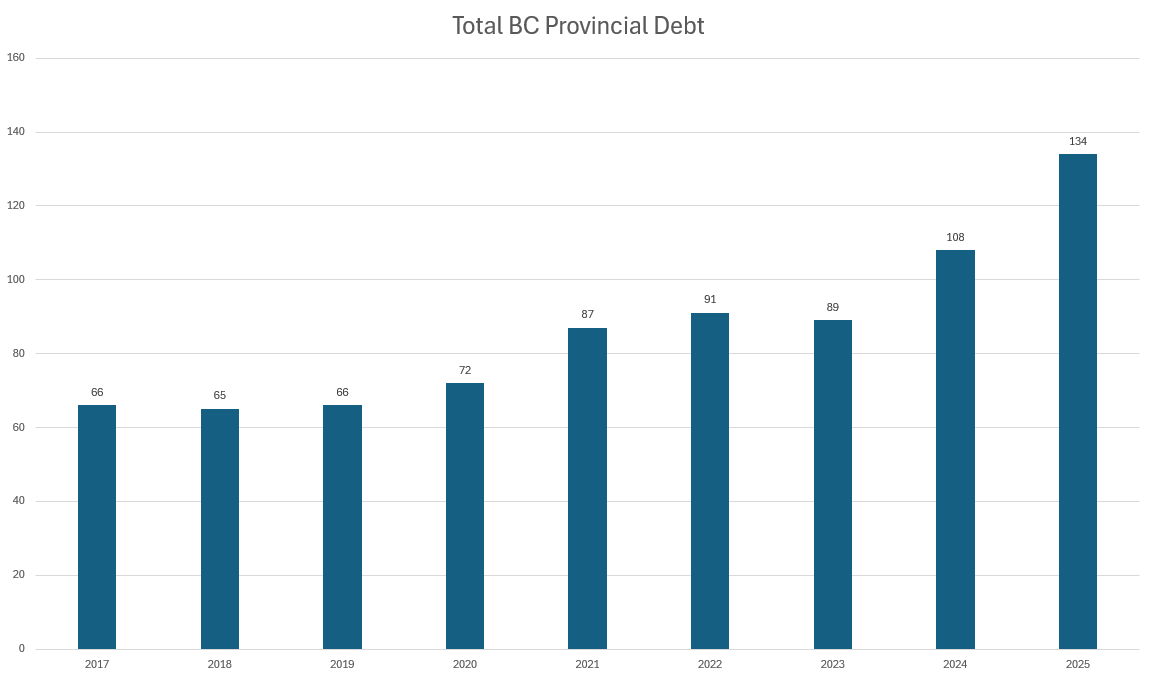

Last week, BC Finance Minister Brenda Bailey released the 2024-2025 BC public accounts. She stated that while the deficit for 2024 ended up being lower than expected, the debt the province holds grew by 50 percent in just two years, from $89 billion in 2023 to $134 billion in 2025.

Information received from the BC Public Accounts. Figures are expressed in billions ($).

Bailey acknowledged that the province was “experiencing increased debt,” but that the borrowing was necessary for the BC NDP to deliver on key promises for education, transportation, and healthcare. “Our government remains committed to ensuring that we support British Columbians, and we're going to continue to do that,” she said.

BC is not alone in deficit spending

Fortunately for BC, many provinces are also running deficits; the standouts are the provinces of Alberta and Nova Scotia, which are expected to run surpluses.

Province Budget Surplus/Deficits (2024-2025 Fiscal Year)

BC with worse financial stability compared to others

BC, compared to its provincial counterparts, has a tough bill of fiscal health. It recently had its credit rating downgraded and is expected to run a deficit for the next four years. Running a deficit isn’t necessarily a bad thing, particularly during tough economic times; but not having a credible plan to return to fiscal stability can ruin a province’s future financial prospects. This can result in investors charging higher interest rates on provincial securities, interest rates that the taxpayers have to pay, with the Premier, the Finance Minister, the Cabinet, or any other legislator not fronting a dime.

Now, BC does not have the worst debt-to-GDP ratio among the provinces nor even the highest deficit in terms of raw numbers; Ontario holds both of those distinctions. However, the BC situation is worse because its debt encompasses a large part of its GDP, two percent compared to Ontario’s one percent, as well as the speed at which the fiscal situation has gotten worse.

The BC Liberals made an effort to be financially prudent and ran budget surpluses, particularly in the 2010s.

BC Operating Surplus/Deficit

During the early years of the BC NDP government, this trend was kept in place, but at the height of the COVID-19 pandemic, the government decided to deficit spend to support the public. When the province began to recover from the pandemic economic shock in 2022 and 2023, the government continued with more infrastructure investments. This meant more and more borrowing, leading to the situation the province is in today.

BC plans to address monetary uncertainty

That being said, the provincial government is aware of the current situation and plans to attempt to solve it. Minister Bailey stated that she takes the problem “very seriously” and that the government “[has] a lot of work to do ahead of us to get back to a path to balance.” But what that path will be remains to be seen.