Poll: 62 percent still see Canadian economy as poor, inflation fears persist

Canadians are showing a modest uptick in economic confidence, but inflation concerns and affordability anxieties continue to cast a long shadow over the country’s financial outlook, according to a new Research Co. poll.

The survey, conducted earlier this month, found that 62 percent of respondents still describe economic conditions as “poor” or “very poor.” While that number is down six points since April, only 35 percent said the country’s economy is in “very good” or “good” shape.

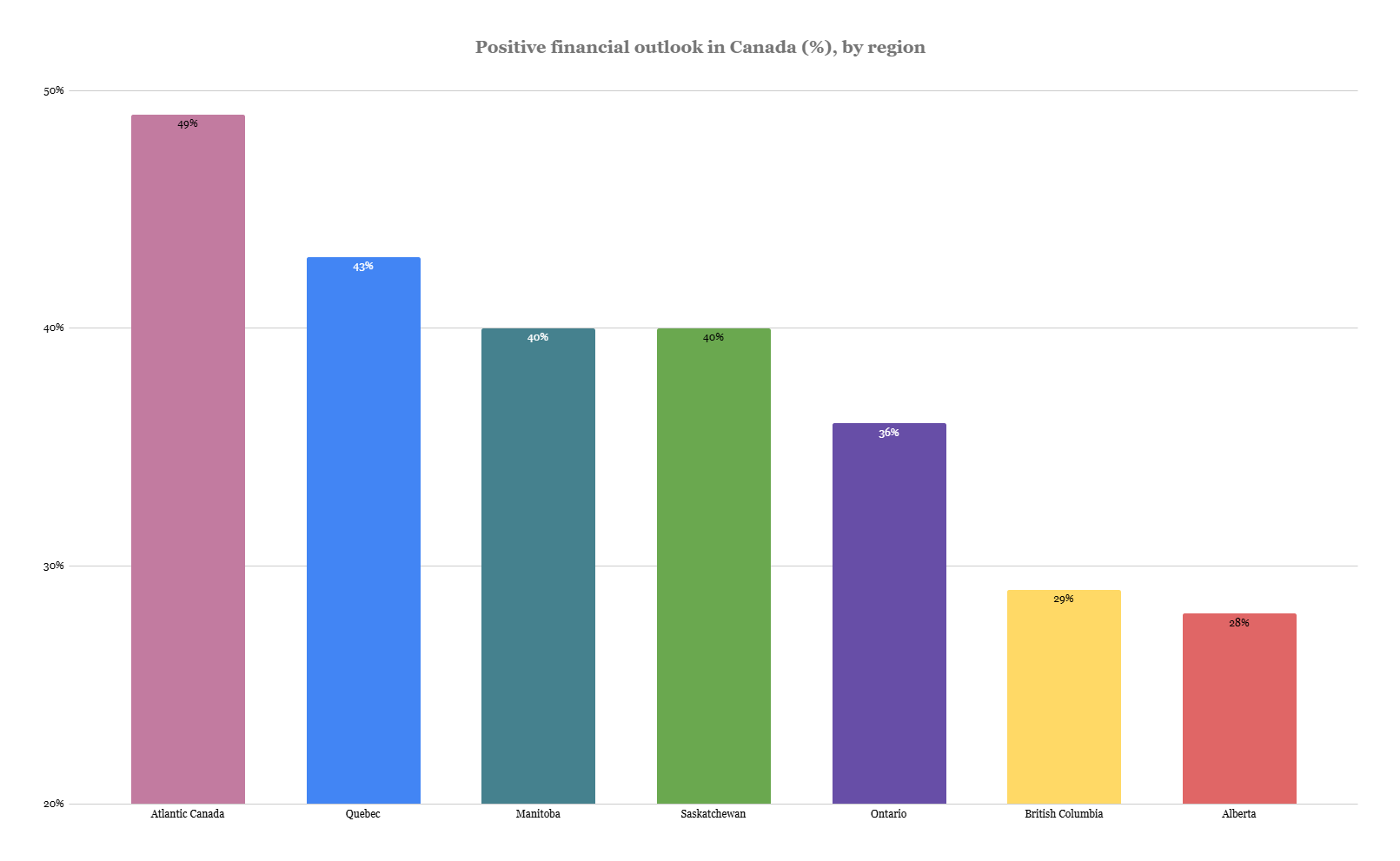

Regional differences remain. Almost half of Atlantic Canadians view the economy positively, compared with just 28 percent in Alberta and 29 percent in British Columbia. Ontario sits slightly higher at 36 percent.

Polling infomation received from Research Co.

Despite the minor gains in confidence, Canadians remain divided on the near-term trajectory of the economy. Equal proportions — 39 percent each — predict it will decline or remain the same over the next six months. Only 15 percent expect improvement.

Inflation worries persist

Even with improved sentiment on the economy, the cost of living dominates Canadians’ concerns. More than three in four expect grocery bills to climb further in the coming months, while two-thirds foresee higher prices for gasoline and new vehicles. Majorities also anticipate rising costs for real estate and electronics such as televisions.

Personal finances show a similarly mixed picture. Half of Canadians say their situation is “very good” or “good,” while 47 percent deem it “poor” or “very poor.”

Compared with April, fewer Canadians report frequent or occasional worries about major setbacks. Still, half have been concerned recently about the safety of their savings or the value of their investments. Four in 10 worry about making mortgage or rent payments, and a similar share about job losses in their household.

Younger Canadians remain especially vulnerable. “More than half of Canadians aged 18-to-34 (52%) have worried about making their mortgage or rent payments,” says Mario Canseco, President of Research Co. “The level of concern is only slightly lower among their counterparts aged 35-to-54 (46%).”

Trust in leadership

The poll highlights ongoing questions about the federal government’s ability to navigate economic turbulence. A majority of Canadians, 58 percent, say they trust Prime Minister Mark Carney to do the right thing for the economy. Yet that figure is down a point since April and reflects little movement despite ongoing pressures on affordability.

Support for Conservative Leader Pierre Poilievre lags at 44 percent nationally, though he performs better among younger Canadians, with 49 percent of those aged 18 to 34 expressing trust. Among Canadians 55 and older — a key voting bloc — only 37 percent say they trust him.

The trust gap between the two leaders remains sharpest among older voters, where Carney maintains an edge. But the persistence of affordability fears suggests Canadians are far from convinced the government has found a solution to rising costs.

Bank of Canada Governor Tiff Macklem fares slightly worse, with two in five Canadians expressing trust in his stewardship, though that represents a five-point improvement since the spring.

Disconnect between perception and reality

The polling suggests that while Canadians may be adjusting to a difficult financial climate, their expectations for relief remain low. The government’s messaging about economic resilience appears to have done little to temper anxiety about day-to-day costs.

The data also show that worries about unemployment, debt and savings have eased slightly. But younger Canadians, renters, and households with lower incomes remain disproportionately burdened.

The poll, conducted online from September 10 to 12 among 1,003 Canadian adults, carries a margin of error of plus or minus 3.1 percentage points, 19 times out of 20.