BC budget posts record $13.3B deficit as debt climbs and taxes rise

(Image courtesy CBC.)

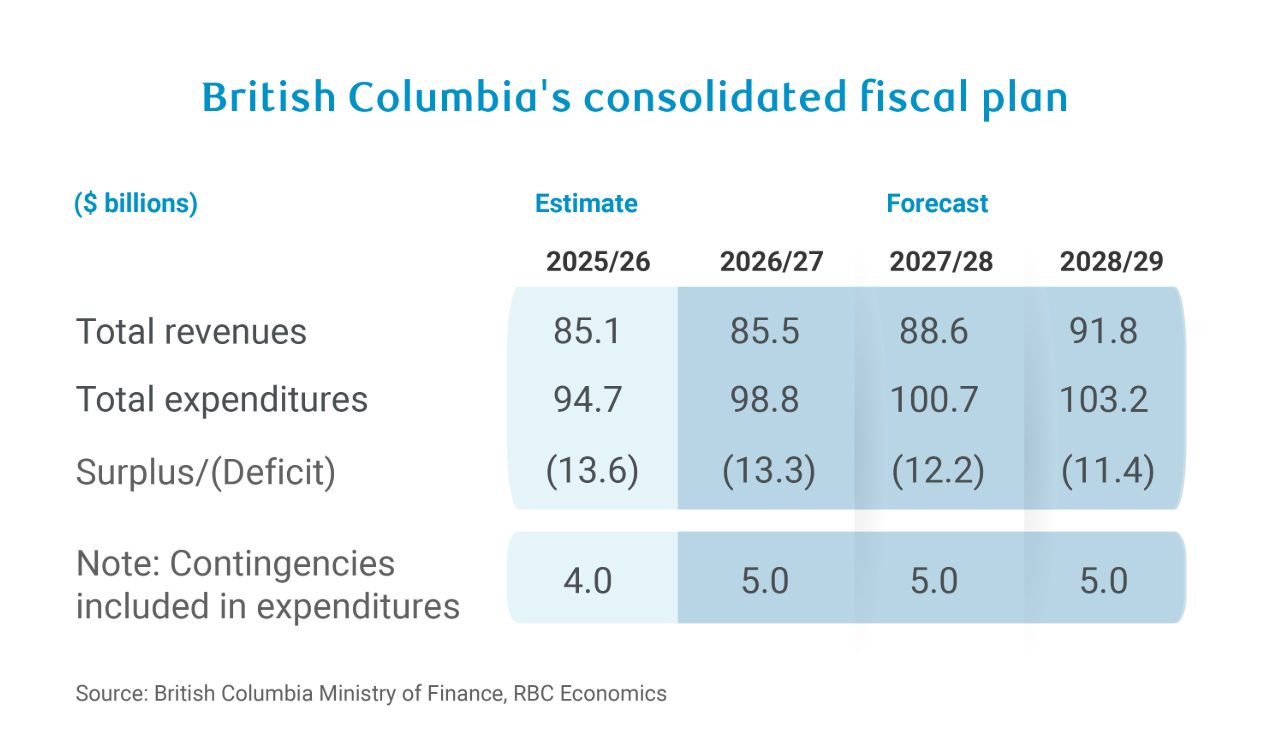

BC’s 2026 budget opens with a record $13.3 billion deficit and no path to balance laid out in the fiscal plan, as the provincial government moves ahead with tax increases and spending restraint measures it says are needed to safeguard core services.

The fiscal plan projects the $13.3 billion shortfall for 2026-27, followed by deficits of $12.2 billion in 2027-28 and $11.4 billion in 2028-29. While the government forecasts the deficit-to-GDP ratio will decline from 2.9 percent in 2026-27 to 2.3 percent by 2028-29, the budget does not project a return to balance within the fiscal plan.

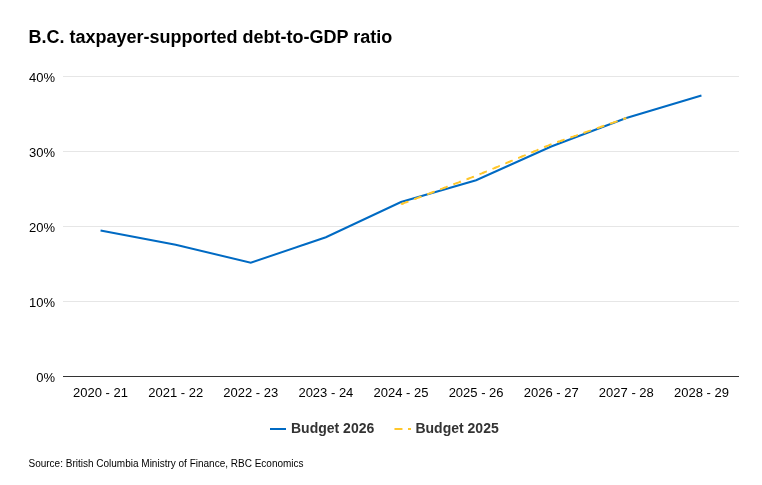

Taxpayer-supported debt is projected to climb to $189 billion by 2028-29, with the debt-to-GDP ratio rising to 37.4 percent over the same period.

Finance Minister Brenda Bailey said the government is making careful choices in uncertain economic times.

“Our investments have allowed us to enter these uncertain times from a position of strength, but we need to be realistic about the difficult financial situation we face as a province,” Bailey said. “We are choosing to safeguard what we’ve built, while growing our economy to secure good jobs and economic prosperity for people and families.”

The deficit outlook comes despite new revenue measures, including an increase to the lowest personal income tax bracket from 5.06 percent to 5.60 percent. The government says the change will mean an additional $76 in income taxes for the average taxpayer in 2026, although more than 40 percent of taxpayers will see savings when combined with an increase to the BC Tax Reduction Credit.

The budget also pauses indexation of tax brackets from 2027 to 2030, expands the provincial sales tax to professional services such as accounting, engineering and security, increases the speculation tax from 3 to 4 percent for foreign owners and untaxed worldwide earners, and raises the Additional School Tax on properties valued above $3 million.

Business groups said the measures add pressure at a time of weak private-sector growth.

“The deficit deteriorates to a record $13.3 billion in 2026/27,” the Business Council of British Columbia said, adding that the shortfall “far eclipses the one during the COVID-19 emergency of 2020/21.”

“B.C.’s finances have unraveled at a breathtaking speed over recent years as spending growth has far outpaced revenue growth,” said David Williams, BCBC’s vice president of policy.

The Surrey & White Rock Board of Trade said the projected deficit raises concerns about long-term sustainability.

“We appreciate that the province is continuing its investment in essential services,” said CEO Joslyn Young. “But businesses are navigating growing cost pressures and unpredictability. Our members need an affordable environment in which to do business and a clear path back to fiscal balance.”

Opposition critics framed the tax measures as a blow to affordability.

“After a decade of reckless NDP spending that turned a surplus into a record $13.3 billion deficit and more than tripled provincial debt to $182 billion, the NDP have run out of money,” said Kerry-Lynne Findlay. “Now David Eby and the NDP are coming after more and more of your hard-earned money with higher and higher taxes.”

Conservative finance critic Peter Milobar said the budget amounts to “an assault on seniors, working families, and the small businesses that drive our economy.”

The government argues the new revenue is needed to protect services. Budget 2026 includes $2.8 billion in new funding for health care over three years, $634 million for K-12 education, $330 million to stabilize child care services, $475 million for children and youth with disabilities, and $139 million to reduce repeat violent offending and chronic property crime.

It also sets aside $283 million for skills training and establishes a new $400 million BC Strategic Investments Special Account to partner with the federal government on major projects.

At the same time, the province says it will reduce the size of the public sector by 15,000 full-time equivalent positions over three years, including a target to cut 2,500 positions from the core BC Public Service, largely through attrition and voluntary departures.

The budget adjusts the timing of several previously announced long-term care projects and Phase 2 of the Burnaby Hospital and Cancer Care project as part of what the government describes as a repacing of its capital plan.

“In the coming years, we need an ambitious capital plan to build public and non-profit care homes,” said Lynn Bueckert, secretary-business manager of the Hospital Employees’ Union. “We hope government will revisit these timelines as the economy stabilizes, because our communities urgently need these investments.”

Debt-servicing costs are projected to rise to $8.7 billion by 2028-29, according to BCBC, which called them the fastest growing line item in the budget.

While the government maintains BC’s debt-to-GDP ratio remains competitive relative to other provinces, Budget 2026 charts a fiscal path that keeps the province in deep deficit even as taxes rise and the government targets spending restraint and staffing reductions — leaving open questions about how and when the books will ultimately be balanced.