With red ink rising, BC’s vehicle mandates and surtaxes come into focus

With BC forecasting a record $13.3 billion deficit and taxpayer-supported debt climbing to $189 billion within three years, attention is turning to policies that affect vehicle sales and consumer costs.

The government’s latest fiscal plan introduces new tax measures and outlines a reduction of 15,000 public-sector positions, while projecting no return to balance within its three-year horizon. Against that backdrop, BC’s Zero Emission Vehicle Act mandates 90 percent zero-emission vehicle sales by 2030 and 100 percent by 2035.

Energy Minister Adrian Dix has acknowledged those timelines may not hold.

“Those current targets, which are at 90 percent by 2030, and 100 percent by 2035, are no longer realistic,” Dix said.

Ottawa recently repealed its Electric Vehicle Availability Standard and is replacing it with stricter greenhouse gas emission standards aimed at reaching 75 percent EV sales by 2035 and 90 percent by 2040, alongside billions in new subsidies and incentives for manufacturers and buyers.

BC has not announced changes to its legislated sales targets.

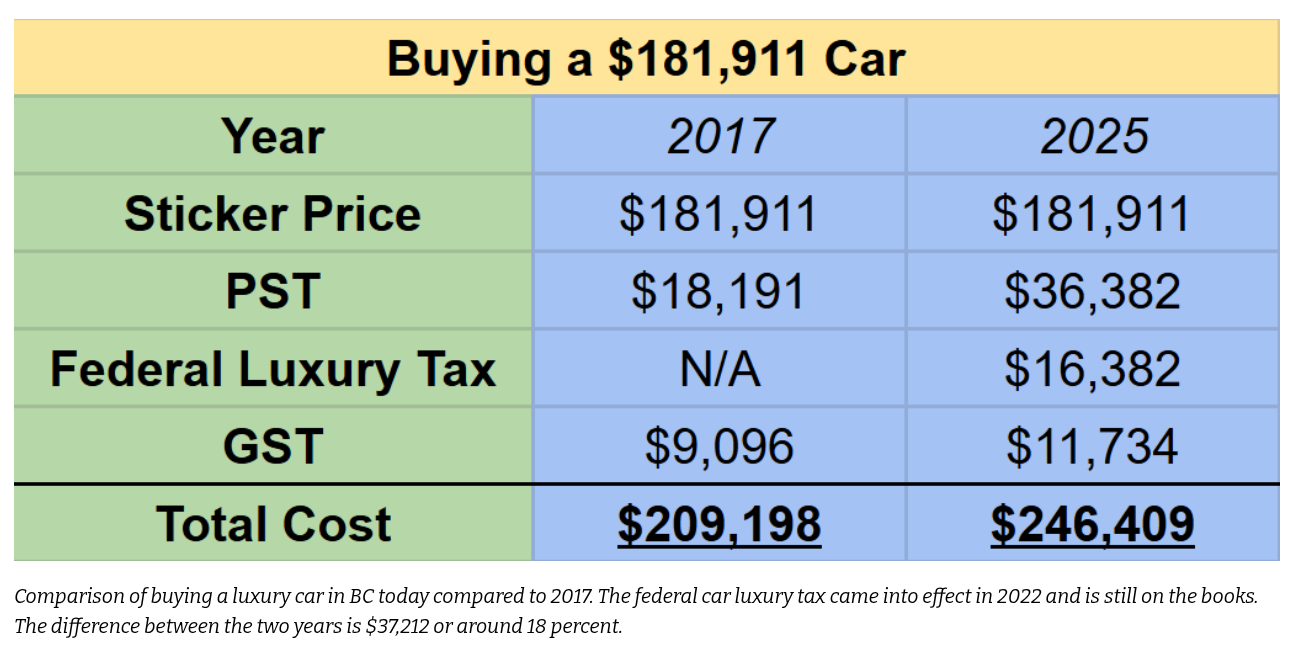

The province also continues to levy a luxury vehicle surtax of 15 percent on cars priced between $125,000 and $149,999.99 and 20 percent on vehicles priced at or above $150,000. The Ministry of Finance says it receives provincial sales tax revenues in lump sums from ICBC and dealers and does not break down how much comes specifically from luxury vehicle sales.

The higher surtax rates were introduced in April 2018. Before the change, vehicles sold for less than $55,000 were subject to seven percent provincial sales tax, rising to 10 percent for vehicles sold at $57,000 or more. The revised structure increased the tax to 15 percent for vehicles priced between $125,000 and $149,999.99 and 20 percent for vehicles at or above $150,000.

A spokesperson for the Ministry of Finance said the province does not track how much revenue is generated specifically from those higher luxury tiers, as PST is remitted in aggregate amounts. The ministry did not provide a breakdown of revenue collected at the 15 percent and 20 percent levels.

Without a revenue breakdown, it is unclear how the province measures the fiscal performance of the surtax, including whether the higher rates are affecting sales volumes or provincial revenue.

Despite mounting fiscal pressures and questions about the feasibility of its targets, BC’s vehicle mandates and luxury surtaxes remain in place as the province projects years of multi-billion-dollar deficits.